Everything Canadian Borrowers Should Understand About Penalties of Fixed-Rate Mortgages

Fixed-Rate Mortgage Penalties

In this article, we are going to talk about a crucial topic, how lenders calculate penalties for fixed-term mortgages.

Though often disregarded, if even noticed at all, the penalties related to fixed-term mortgages can have an enormous impact on your borrowing cost. Not surprisingly, the lenders with the most substantial penalties aren’t the best at making sure you know what you’re getting yourself into. As we’ll see, this is one of the reasons the small print is so tiny.

Based on mortgage rates staying at a similar level, penalties on a mortgage of $250,000 could be over $7,000 if it is broken within three years. The most expensive penalties for a five-year fixed-rate mortgage can be more than five times as high as the cheapest. Though nobody expects to need to end their mortgage prematurely, the unexpected can, and often will, happen in life. As a result, many homeowners with fixed-rate mortgages tend to break it earlier than they had planned, and need to pay large sums of money for penalties that they hadn’t necessarily budgeted for

In the current market, it is essential to be aware of how these fixed-rate mortgage penalties are calculated due to the different methods used being more pronounced if rates rise only slightly, or remain the same, for a long time. This is exactly what analysts are predicting for the coming years.

Let’s get down to ensuring you understand what could be the most vital piece of fine print in your fixed-rate mortgage contract.

To begin with, surprising as it may be, many lenders will use basically the same definition for their penalties on fixed-rate mortgages. It tends to be “the greater of interest rate differential (IRD) or three months interest.”

The main difference is in the IRD calculation, the rates that are used. Let’s take a look at an example.

- You have a $250,000 mortgage with a rate of 2.59% fixed for five years.

- You’ve had your mortgage for three years.

- Interest rates today are precisely the same as when you took the mortgage.

First, we can calculate how much three months of interest would be:

2.59% X $250,000 X (3/12) = $1,619

Then it is just a matter of lenders comparing this to their IRD calculation and charging you whichever is higher.

There are three ways for IRD penalties to be calculated: Standard, Discounted, or Posted.

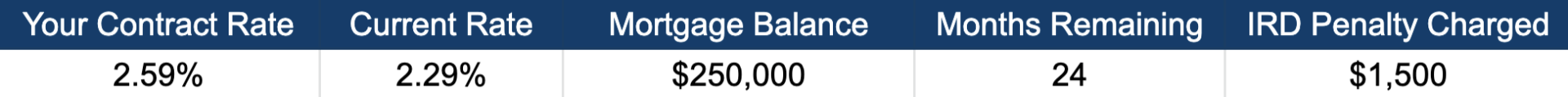

Standard Calculation of IRD

With a standard IRD calculation, the lender will find the difference between your current interest rate (2.59%) and the rate they currently offer that is most similar to the remaining term of your existing mortgage. In this case, you have two years left on your mortgage, so they would use their current two year fixed rate. In this example, we’ll assume it is 2.29% (a competitive rate in today’s market).

They will then take the difference (0.30% in this case) and multiply it by the remaining balance of your mortgage, and the time remaining.

This is the calculation:

(2.59% - 2.29%) X $250,000 X (24/12) = $1,500

Here are the definitions of each figure in this calculation:

This is the standard calculation for IRD. Many lenders will use this calculation to remain competitive with others who offer some of the best mortgage rates around.

In this example, the IRD calculation ($1,500) is lower than three months interest ($1,619), so you would be charged the latter ($1,619) to end your mortgage early.

Now we’re going to see how understanding the fine print can save you money.

Some lenders have adjusted their IRD calculation to give themselves much more favourable results. As we’ll see below, this can have a real impact on the cost of any penalty you may have to pay.

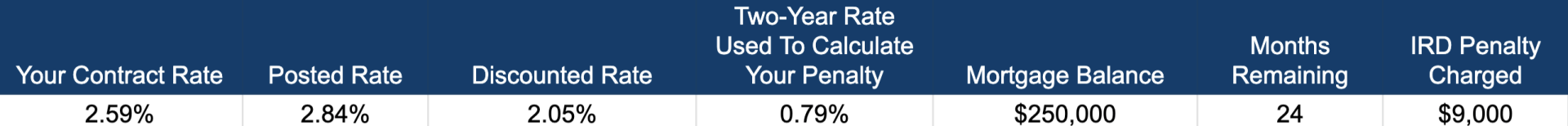

Discounted-Rate Calculation of IRD

Several major lenders use this calculation method, and you shouldn’t be fooled by the name.

Lenders will still start with your current rate, but they will compare this with their most similar current rate, MINUS the discount you received on the first rate.

For example, the Big Six Banks’ average rates for five year fixed mortgages is currently 4.64%. Our rate of 2.59% will have come with a discount of 2.05%

So, the lender will take the discount you received on your original rate and apply this discount to the two-year rate used in the IRD calculation.

This small change to the fine print has a significant impact on the financial cost of your penalty. Two-year mortgage rates are discounted at a much lower rate than five-year rates. The discount for a five-year fixed-rate mortgage might be 2.05%, but that of a two year fixed rate would be closed to 0.65%.

As a result, this has a serious impact on the IRD calculation:

(2.59% - 0.79%) X $250,000 X (24/12) = $9,000

Here are the definitions of each figure in this calculation:

Thought that was painful?

Our next example will show just how high penalty fees can go if you don’t understand the IRD calculation used.

Posted-Rate Calculation of IRD

Some other lenders use a posted-rate calculation for their IRD

Using the same rates as our previous examples would generate a similar size of penalty using a posted rate calculation. If the rates are higher (which can go hand in hand with this IRD calculation), the penalties can be far higher.

With this calculation, the lender will take the five-year fixed-rate BEFORE any discount, and calculate this difference between this and the most similar rate they have for the remaining fixed term of your mortgage.

The lender will argue that this is fair as they will use the posted (pre-discount) rate for both the initial rate and that of the most similar term rate they are currently posting. As we’ve already discussed, the problem with this is that lenders offer substantial discounts on five-year terms and drastically smaller discounts for two-year fixed-term mortgages. The result is a more significant difference between the two, and a more significant penalty fee to be paid.

Here is an example of a posted-rate calculation of an IRD penalty:

(4.79% - 2.84%) X $250,000 X (24/12) = $9,750

Here are the definitions of each figure in this calculation:New Paragraph

It’s not surprising that lenders use these tactics as the penalties bring in vast sums of money for them when unsuspecting borrowers decide to engage with lenders directly.

In principle, these penalties are understandable. If a mortgage is broken, costs will be incurred by the lender, and the penalty is designed to ensure that these costs are covered and to reimburse part of their lost earnings.

It isn’t fair that some lenders will use these mortgage breaks to surprise you with extortionate and unexpected penalty costs.

Most people looking for a mortgage have no idea of the significant financial risks they might be taking with lenders based on how their mortgage breaking penalties are calculated. Unfortunately, the lenders who have profited through these penalties are not in a rush to advise consumers of the risks they may be taking.

Though the government acknowledges the public’s frustration and pain because of these unfair practices, they seem to be in no hurry to force lenders to offer a more transparent service to borrowers.

Hopefully, this article will serve to inform you of the pitfalls you may face when looking to take out a mortgage and better understand the small print, which could see your potential future penalty fees increase substantially.

Have more questions? Get ahold of us!

We're on Instagram!

instagram.com/thrivemortgageco

instaggram.com/theyvrremoshow

Check us out on Facebook!

How to Reach US!

📲

Call 604.398.5575 or Email us!

More Questions or READY to get started!?

Just Ask US > Click Here to set up a call or EMAIL us